The Congressional Budget Office yesterday published its annual 10-year economic outlook. It says, essentially, the economy will continue expanding for the coming decade at the tepid pace of the last decade. It predicts a slow-growth “new normal” of 1.9% annual expansion extending through 2027. If nothing changed, CBO might very well be correct. Yet it’s possible, even likely, that economic policy will change more in the next few years than any time since the early 1980s, maybe even since the 1930s.

CBO projects growth of 2.3% this year, then 2.0% in 2018, 1.7% in 2019, 1.5% in 2020, 1.8% in 2021, and 1.9% from 2022-2027. It’s a tragic outcome if it comes to pass. We see below what a 1.9% economy got us over the last decade: a gigantic growth gap of around $2.8 trillion in lost output, compared to what we might have expected.

A continuation of the new normal would only compound this shortfall, compared to our economy’s likely potential. In fact, CBO also includes in its latest report an appendix showing the potential effects of productivity growth *even slower* than its central estimate. To be fair, CBO is not predicting slower productivity, just offering useful heuristics to estimate the economic and budgetary effects of slower productivity growth. I think, however, that variance from the baseline scenario will be just the opposite — that productivity growth will surprise to the *upside* over the next 10 years.

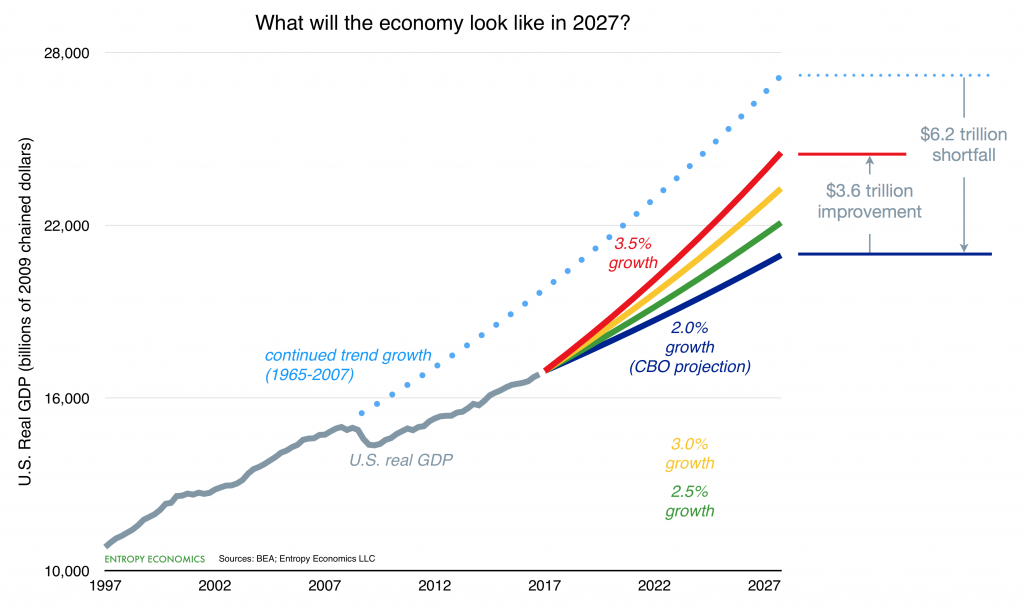

The chart above illustrates these scenarios over the coming decade. The gray line is actual real GDP. The light blue dotted line is what the economy would have looked like had the U.S. continued growing at its historical rate after 2007. The growth gap today, at the start of 2017, stands at something like $2.8 trillion (the difference between the gray line and the blue dotted line). Others, using more conservative assumptions, find a gap of around $2 trillion, still a huge shortfall.

The dark blue line is roughly CBO’s projection for the next 10 years — around 2.0% annual growth — which is a continuation of the roughly 2% we’ve experienced in the current expansion. If CBO is correct, the U.S. economy will be something like $6.2 trillion smaller in 2027 compared to what we might have expected in 2007.

The green line shows 2.5% growth, and yellow shows 3.0%, which was about the U.S. average between 1965 and 2007.

The red line shows 3.5%, which many analysts believe is too ambitious a scenario. They think, with some reason, the U.S. economy is maturing and is on a permanently lower growth path than before. Perhaps in the very long term 3.5% is too optimistic. Who knows? But I think the U.S. can grow at 4% or more for the next few years before returning to the longterm average of 3%, which could sum to around 3.5% over the next decade. I say this for three reasons:

(1) The U.S. economy never really recovered from the financial panic and Great Recession. Investment has been weak, job growth was steady but very slow, and entrepreneurship has been wanting. The overall policy environment — on taxes, regulation, and monetary management — has discouraged growth. There’s lots of room to make up.

(2) The policy environment could improve dramatically over the coming years. Big reforms of the tax code and regulatory approaches across dozens of agencies could unleash investment and innovation that’s been pent up for years. Such huge potential policy changes will not only allow us to “catch up” some lost growth from the last decade but can also boost our top-line frontier of innovation and thus growth potential. (There are also of course policy risks, such as rising protectionism, and global risks, such as China’s fragile economy. Yet I think the balance tilts toward growth.)

(3) The productivity plunge of the last decade is nearly over. I believe, based on what I’m seeing across the technology landscape, we are the cusp of a productivity boom. I will have much more to say about this in a forthcoming paper. But if it happens, the productivity increases I’m estimating could lift annual economic growth by nearly a percentage point over the coming decade.

Combining these three factors, I think the red 3.5% growth scenario through 2027 is possible. It would represent a $3.6 trillion GDP improvement over CBO’s estimate for the 2027 economy.

— Bret Swanson